Why Alternative Cryptocurrencies Exist

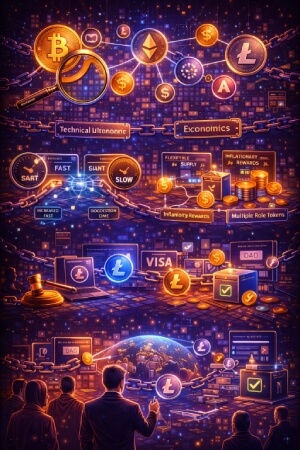

This situation is not just competition between the original Bitcoin and all the rest. It's basically an ongoing experiment in terms of pushing the limitations of blockchain design and meeting needs of a broader group of users, developers, and institutions. Bitcoin has been focusing on simplicity and safety, while the other projects are investigating different trade-offs in terms of transaction speeds, governance, programmability, and incentives.

These alternatives generally express specific questions, questions like whether quicker transactions can be brought around without sacrificing decentralization, whether network changes will be more adaptive, or whether technologies can support some of the more complex applications beyond simple payments. In all cases, every new cryptocurrency becomes an attempt to answer one or more of these questions.

Technical Limitations as a Starting Point

Bitcoin's design emphasizes robustness and resistance to change, but that stability comes with constraints. Transaction throughput is limited, confirmation times can be slow during periods of high demand, and the scripting language is intentionally narrow. For some developers, these limitations are features. For others, they are problems to solve.

Alternative cryptocurrencies often begin by adjusting these parameters. Some increase block sizes or reduce block times to allow more transactions per second. Others redesign how data is stored or validated. These changes may improve performance, but they also introduce new risks, such as higher hardware requirements or greater centralization among validators

Economic Diversity and Incentive Design

Beyond technical concerns, alternative cryptocurrencies experiment with different economic models. Bitcoin's fixed supply and predictable issuance schedule appeal to those who see it as digital scarcity. Other projects challenge this idea by introducing flexible supply mechanisms, inflationary rewards, or tokens that serve multiple roles within a network.

These economic choices affect how users behave. Inflationary models may encourage spending and participation, while capped supplies may encourage holding. Some networks separate transaction fees from validator rewards, while others tie governance power directly to token ownership. Each approach reflects a different philosophy about how digital economies should function.

Governance and Decision-Making Structures

Bitcoin relies heavily on informal consensus and slow, conservative change. Alternative cryptocurrencies often seek more explicit governance mechanisms. Some embed voting systems directly into the protocol, allowing token holders to approve upgrades or parameter changes. Others rely on foundations or councils to coordinate development.

These governance models aim to balance flexibility with legitimacy. Formal governance can speed up decision-making, but it may also concentrate power. Informal governance can protect decentralization, but it can struggle to adapt. The diversity of approaches reflects ongoing uncertainty about how decentralized systems should evolve over time.

Different Technical Approaches to Consensus

Every cryptocurrency in existence today has a technique for reaching consensus on the ledger. Bitcoin does this using the mechanism called proof of work, which makes the network secure through computational efforts. Other altcoins are exploring other consensus methods in search of efficiency, scalability, or environmental sustainability.

Such technical choices have significant implications for who is able to participate in securing the network. Consensus mechanisms can influence hardware requirements, energy consumption, and the spread of power among participants.

Proof of Stake and Its Variations

Proof of stake replaces computational competition with economic commitment. Validators lock up tokens as collateral and are rewarded for honest behavior. This approach reduces energy consumption and can allow faster transaction finality, but it introduces new challenges around wealth concentration and security assumptions.

Different implementations of proof of stake address these issues in varied ways. Some limit the influence of large stakeholders through delegation or rotation. Others impose penalties for inactivity or misconduct. These variations demonstrate how consensus design is as much about social assumptions as it is about technical rules.

Hybrid and Alternative Consensus Models

Beyond proof of work and proof of stake, some cryptocurrencies adopt hybrid models or entirely different approaches. These may combine multiple mechanisms to balance security and efficiency or introduce novel concepts such as reputation-based validation or time-weighted participation.

While these models can be innovative, they are often less tested. New consensus mechanisms may perform well in theory but reveal weaknesses under real-world conditions. As a result, many alternative cryptocurrencies serve as live experiments, providing data and experience that inform future designs.

Trade-Offs Between Security and Performance

Every consensus mechanism involves trade-offs. Faster confirmation times may increase the risk of network forks. Lower hardware requirements may make networks more accessible but easier to attack. Higher throughput may reduce decentralization if only a few participants can afford to run full nodes.

Alternative cryptocurrencies make these trade-offs explicit. By comparing different networks, observers can see how design choices affect real-world outcomes. This comparative perspective helps clarify what properties are most important for different use cases.

Expanding Use Cases Beyond Payments

Where Bitcoin mainly concerns itself with the transfer of value, altcoins increasingly aim to create conditions in which more applications can occur. Programmable Contracts (Smart Contracts), Distributed Apps (DApps), and digital representations of real-world assets to be tokenized fall into this broad category of applications. This expansion in general alters people's imagination of what cryptos can accomplish.

Programmable Logic and Smart Contracts

Some cryptocurrencies introduce programmable logic that allows developers to create automated agreements and applications directly on the blockchain. These systems enable decentralized exchanges, lending platforms, and other services without traditional intermediaries.

This flexibility comes with complexity. Programmable systems are more powerful but also more prone to errors. Bugs in code can lead to financial losses, and upgrading deployed applications can be difficult. As a result, these platforms emphasize tooling, audits, and community standards to manage risk.

Tokens as Functional Components

In many alternative networks, tokens serve specific functions beyond payment. They may represent voting power, access rights, or claims on future resources. This functional diversity allows systems to align incentives more precisely with desired behavior.

However, multifunctional tokens can be harder to understand and value. Users must consider not only market price but also utility and governance implications. This complexity raises questions about transparency and user protection, especially as these systems reach wider audiences.

Integration With External Systems

Some cryptocurrencies focus on bridging on-chain systems with off-chain data and assets. These integrations enable applications that respond to real-world events or represent ownership of physical goods. Such designs expand the relevance of blockchain technology but introduce new trust assumptions.

Reliance on external data sources can weaken decentralization if those sources are controlled by a few entities. Alternative projects address this by distributing data provision across multiple participants or using economic incentives to encourage accuracy.

Economic Experiments and Monetary Policy

Other cryptocurrencies are extremely testing for new application of monetary policy. The software encoded rules allow systems to test policies that traditional finance could not accommodate. A suitable alternative over experimental research and policy testing would be provided to understand how digital economies are hypothesized to function.

Nevertheless, no computerized monetary system is free from the interference of human beings. Market dynamics, speculation, and external variables can disrupt even the best-modeled algorithms. Observing these results allows for an understanding of the limitations and constraints involved with automatic economic control.

Fixed Supply Versus Elastic Models

Some cryptocurrencies adopt fixed or capped supplies similar to Bitcoin, emphasizing scarcity. Others use elastic supply models that expand or contract based on demand. These designs aim to stabilize value or support specific economic goals.

Elastic models can reduce volatility in theory, but they rely on assumptions about market behavior and data accuracy. When these assumptions fail, outcomes can be unpredictable. The contrast between fixed and elastic systems highlights different views on the role of money in digital economies.

Incentives for Network Participation

Monetary design also affects who participates in a network and how. Block rewards, staking returns, and fee structures influence validator behavior and user costs. Some networks prioritize low fees to encourage adoption, while others emphasize high rewards to secure participation.

Balancing these incentives is an ongoing challenge. Excessive rewards can lead to inflation, while insufficient incentives can weaken security. Alternative cryptocurrencies adjust these parameters over time, reflecting learning through experience.

Risk, Speculation, and Stability

Economic experimentation inevitably attracts speculation. Price volatility can overshadow utility, making it difficult for users to assess long-term value. This volatility raises concerns about consumer protection and systemic risk.

Some projects attempt to mitigate these issues through design choices or communication strategies. Others accept volatility as an unavoidable feature of early-stage experimentation. Across the landscape, the tension between innovation and stability remains unresolved.

Regulation, Compliance, and Public Trust

Increased scrutiny from regulators could be seen on the back of the fast-growing landscape of cryptocurrencies. Different cryptocurrencies are situated within parallel landscapes of the law that are dissimilar in every jurisdiction's use and case. Compliant considerations can color the design process every bit as much as technical ambition.

Regulation can encase experimentation for certain purposes, but it can provide clarity and protection. Projects that can play by the rules of the rights of regulatory frameworks may gain recognition, while projects with no nod to them in their practice might face exclusion from the mainstream.

Designing With Regulation in Mind

Some alternative cryptocurrencies incorporate compliance features directly into their protocols. These may include identity layers, transaction controls, or optional privacy settings that align with legal requirements. Such designs aim to balance decentralization with accountability.

Embedding compliance raises philosophical questions about the purpose of cryptocurrencies. For some, regulatory alignment is a necessary step toward adoption. For others, it undermines the original goal of censorship-resistant systems. The diversity of approaches reflects these competing priorities.

User Protection and Transparency

Public trust depends on transparency and clear communication. Complex systems can obscure risks, making it difficult for users to make informed decisions. Alternative cryptocurrencies address this through documentation, audits, and governance disclosures.

Despite these efforts, information asymmetry remains a challenge. Developers and early participants often have more knowledge than new users. Improving education and disclosure is therefore as important as technical innovation in building sustainable ecosystems.

A Landscape Defined by Experimentation

Far beyond Bitcoin, there exists a vast, emerging ecosystem where experimentation rather than consensus reigns supreme. Other cryptos are here to test out new technology designs, economic models, and governance structures, each bringing its own set of complications and possibilities. Successful experiments will fail, while some will lay the groundwork for future systems, and a few may actually stick around as finalized parts of the digital economy. Collectively, they demonstrate that cryptocurrencies are not a single concept but a kind of unending work that looks to understand just how digital value can get created, managed, and chained.